Many businesses look at competitors when deciding which categories to use on their Google Business Profile. On the surface, this makes sense. If another business is ranking well, it is tempting to copy what they are doing. In practice, this approach often causes more problems than it solves.

Copying categories blindly can backfire because competitors rank for many reasons, not just their category choices. Reviews, location, history, and overall profile health all play a role. Categories are only one part of a much larger picture.

Effective category research is about spotting patterns, not imitation. Reverse engineering means understanding why certain categories work in a specific context and whether they truly apply to your business. When done carefully, studying competitor google business categories can reveal useful insights without creating relevance issues. This guide explains how to analyze competitor categories safely and use that information in a way that supports long-term visibility rather than harming it.

Table of Contents

ToggleCompetitor category research can be useful because it shows how Google is interpreting similar businesses in your area. By reviewing which categories appear across top results, you can spot patterns in how services are being classified and which options Google seems to recognize as relevant.

At the same time, categories alone do not explain rankings. Two businesses can use the same category and perform very differently due to reviews, proximity, profile history, or overall consistency. This is why copying a competitor’s categories rarely produces the same outcome.

The key difference is learning versus copying. Learning means observing trends and understanding intent. Copying means assuming the same setup will work without context.

Competitor research adds value when it is used as a reference point and combined with proven category optimization techniques, rather than guesswork.

In competitive local markets, Google relies on categories to group similar businesses before it compares anything else. Categories help Google decide which listings belong in the same search pool and should be evaluated against each other.

Even businesses that look nearly identical can rank very differently. That is because categories only establish relevance. Google then looks at other signals like reviews, proximity, engagement, and profile history to decide which businesses deserve visibility.

Categories provide context, not guarantees. A business with accurate categories but weak supporting signals may still underperform. At the same time, a business with strong reviews and activity but unclear categories may never enter the ranking comparison at all.

Google consistently favors clarity over mimicry. Profiles that clearly describe what they offer, and support those claims with real signals, tend to perform better than profiles that copy competitor categories without alignment.

Before looking at categories, it is important to make sure you are studying the right competitors. Analyzing the wrong profiles leads to false conclusions and poor category decisions.

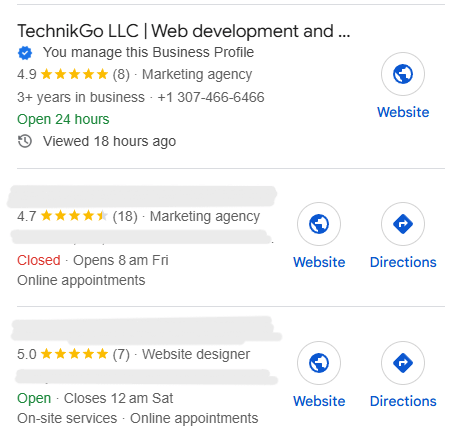

A real competitor in Google Maps is not always the same as a business competitor in the real world. Search competitors are the businesses that appear for the same searches you want to show up for, not just companies offering similar services.

Top-ranking profiles matter most because they represent what Google already considers relevant for those searches. Focus on businesses that consistently appear in the local pack for your core services.

Avoid irrelevant comparisons. Businesses that rank for different locations, services, or customer intent may use categories that do not apply to you and can mislead your analysis.

Location plays a major role in Maps results. Google applies location bias, meaning nearby businesses can appear even with weaker category alignment.

Because of this, categories used by very close competitors may not perform the same way for businesses farther away. Always consider proximity when interpreting category choices, especially in dense or highly competitive areas.

The primary category carries the most weight in Google Business Profiles, which is why it is also the easiest to misuse when copying competitors. Understanding how to analyze it correctly prevents the most common category mistake.

Look for patterns among top results rather than focusing on a single competitor. When several high-ranking profiles use the same primary category, it often signals how Google classifies that service in your area.

At the same time, a category that fits competitors may not fit your business. Differences in services, specialization, or customer focus can make the same category a poor match for you.

A primary category is misleading when it sounds broader than what the business actually offers or does not align with website content, reviews, or photos. If the category cannot be clearly supported by real-world signals, it is likely not the right choice, even if competitors use it.

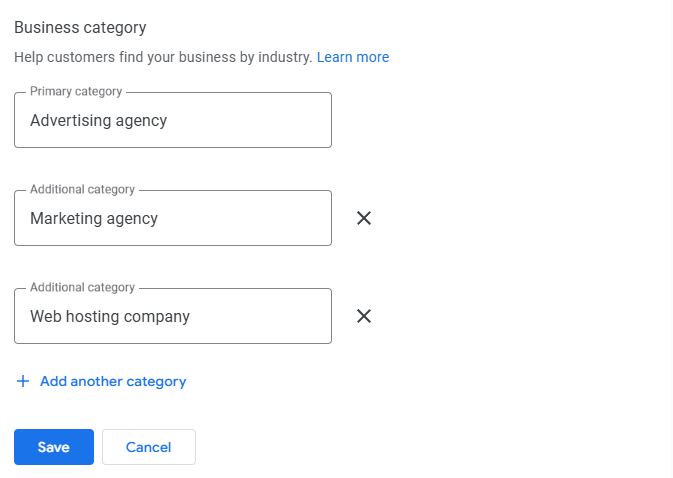

Secondary categories require extra care during competitor analysis. Many competitors use far more secondary categories than necessary, often adding every option that feels loosely related. This does not mean those categories are helping them rank.

Competitors often add multiple secondary categories to cover edge services or past offerings. Google does not treat all of these equally. Some may be ignored, while others may even dilute clarity.

To evaluate secondary categories correctly, separate supportive categories from conflicting ones. Supportive categories closely reinforce the primary service and match what customers clearly expect. Conflicting categories pull the profile in different directions or describe services that are not central to the business.

Secondary categories mainly indicate context, not ranking power. When a competitor’s secondary categories do not clearly match their website content, reviews, or photos, they are usually safe to ignore. Focus only on categories that genuinely align with how Google classifies that service in your market.

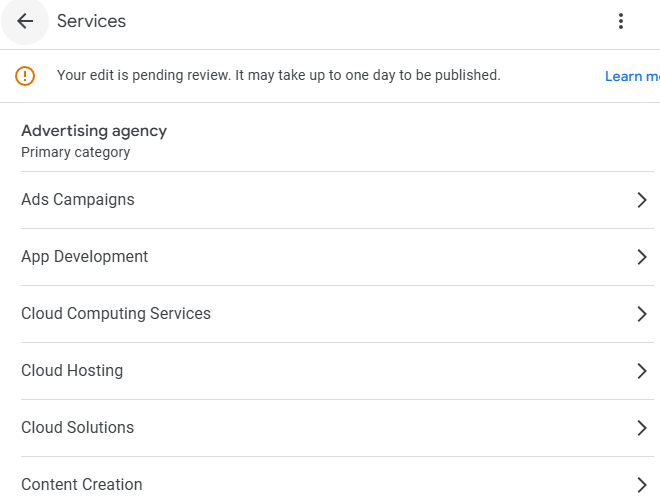

Categories only tell part of the story. To understand whether a competitor’s category choice actually works, you need to compare it against real-world signals that Google uses to verify accuracy.

Start with the competitor’s website. Look at how services are described, which offerings are emphasized, and whether the category clearly matches the core business. If the category suggests a service that is barely mentioned or hidden, it is a weak signal.

Next, read customer reviews. Reviews often reveal what customers actually experience and what they value. If reviews consistently mention services that align with the category, it adds credibility. If they do not, the category may be misleading.

Photos also matter. Images of work, locations, and services help confirm what a business truly offers. Google cross-checks categories with websites, reviews, and photos to assess trust.

This step helps avoid repeating common category mistakes that quietly reduce visibility.

Competitor research only becomes useful when you filter it through your own business reality. Not every category that works for a competitor will work for you, even if you operate in the same area.

Start by comparing competitor categories with your actual services. Ask whether you offer the same core service at the same level of focus. A category is transferable only when it clearly matches what you do and what customers consistently come to you for.

A category should be ignored when it reflects a service you do not actively promote, deliver at scale, or support with content, reviews, and photos. Using it anyway often creates misalignment and weakens relevance.

Alignment matters more than similarity. Google rewards profiles that accurately reflect real-world services. Categories that fit your business clearly will outperform copied categories that only look similar on the surface.

Competitor research can provide useful direction, but it has limits. Some businesses follow the patterns, adjust their categories carefully, and still struggle to gain consistent visibility. When this happens, the issue is usually broader than category choices alone.

Other elements like service alignment, profile completeness, engagement signals, or historical inconsistencies may be affecting performance. Competitor insights work best when they are applied within a strong overall profile. Without that foundation, even well-researched category changes may not produce results.

For businesses that want expert help applying competitor insights without harming relevance, working with a professional Google My Business Optimization Service can help identify gaps and apply changes safely.

At this stage, a deeper review helps connect competitor research with real-world signals and long-term stability.

Competitor data should be treated as reference material, not a set of rules to follow. Use it to understand how Google groups similar businesses, not to copy exact category setups.

Always prioritize your own service clarity. Categories should describe what your business actually offers, not what competitors appear to rank for. Clear alignment between categories and real services makes your profile easier for Google to trust.

Review categories quarterly rather than reacting to short-term changes in rankings. This allows enough time to evaluate patterns and avoid unnecessary edits that can create instability.

Restraint builds trust with Google. Profiles that remain accurate, consistent, and stable over time tend to perform better than those that frequently adjust categories based on competitor movements.

Competitor category research is about understanding patterns, not copying setups. Looking at how other businesses are categorized can reveal how Google groups services in your area, but it does not replace clear decision-making.

Copying categories blindly often creates relevance problems. When categories do not match your real services, Google becomes less confident showing your business for the right searches.

Primary category alignment matters more than imitation. A category that accurately reflects what you do will outperform a copied category that only looks similar on the surface.

Smart analysis supports long-term visibility. Take time to review competitor categories carefully and compare them against your own real services before making changes.